Although the beginning of the year started off with a feeling of uncertainty, it appears we are now finally headed towards some positive news. GDP growth which was at 2.0% at the beginning of the year has picked up and is expected to continue to rise, reaching an expected figure of around 3.4% in 2018. On the other hand, the introduction of VAT is likely to raise inflation from 3.7% in 2017 to 4.8% in 2018.

So, what does this all mean for salary pay trends in the UAE for 2017-2018, and how will this affect employers and employees?

Basic Salary

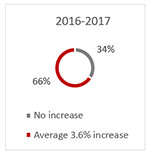

In 2016-2017, the overall trend for increase in basic salary was about 2.5% in the UAE. The diagram on the left summarizes the percentage of people that received an increase in basic salary versus those who received no increase, in companies that implemented a pay review in 2017. 66% of the employees received an average increase of 3.6% in their basic salary, while 34% of the employees did not receive any increase in basic salary.

In 2016-2017, the overall trend for increase in basic salary was about 2.5% in the UAE. The diagram on the left summarizes the percentage of people that received an increase in basic salary versus those who received no increase, in companies that implemented a pay review in 2017. 66% of the employees received an average increase of 3.6% in their basic salary, while 34% of the employees did not receive any increase in basic salary.

So how did this further break down across all job levels, grades and industry sectors? The tables below summarize the differences in basic pay trends at different job levels and across industry sectors during 2017.

While senior management and management level employees enjoyed pay rises between 2.4% to 3.0%, increases for clerical roles were as low as 1.8%. Moreover, there was a complete reversal in the pay trends across industry sectors this year. In 2016 we saw Healthcare, FMCG, Technology and Automotive industries enjoy the highest increase which went up to as high as 7.0%. However, this year, these very industry sectors have seen the lowest increase. In fact, the Healthcare industry saw a decrease of up to -1.0% in 2017. The Transportation, Logistics and Cargo industries enjoyed the highest increase during 2017 which went up to 4.0%, followed by the Insurance, Retail, Pharma and Education sectors.

UAE Nationals

2016-2017 saw the gap between the salaries paid to UAE Nationals versus Expatriates grow, with UAE Nationals being paid 40% to 60% higher on guaranteed cash. At lower level roles the difference was around AED 2,500 per month, however at higher level management roles this gap was as big as AED 10,000 per month.

Allowances

While basic salary increased by 2.5%, allowances increased by only about 1.5% in 2016-2017. This means that guaranteed fixed cash increased by 2.1% this year. Allowances remained at the 60:40 split and housing allowances were as good as frozen. While this may not have affected residents of Dubai negatively, as housing rental costs dropped by 5.0%, residents in Abu Dhabi would have felt the squeeze as housing rental costs in Abu Dhabi increased this year.

Bonus Payment

Actual bonus payments in early-2017 were at about 85% of On-Target which was down from 90% of On-Target from the previous year. The overall impact of this puts the increase of total cash earnings at about 2.0% compared to 1.9% in 2016.

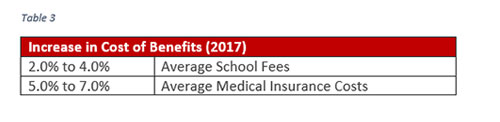

Benefits

This year, the average school fees and medical insurance costs in the UAE increased as illustrated in the table below.

As a result of this, the overall cost of benefits rose by 5.0% to 7.0% and became a cause for concern as the limits were not in line with the actual expenditure. In fact, education allowances in 2016-2017 were seen to be reimbursed at an average of 70.0% to 75.0% of the actual costs, continuing to make it more of a subsidy rather than an allowance.

In conclusion, after studying the pay trends from 2012 up to 2017, and analyzing the forecasts for 2018, it seems that pay trends will remain stable at 3.0% in 2018. However, if we look at this in terms of real increases (after the impact of inflation), it appears that pay increases will not keep pace with inflation in 2018, just like 2017.

What Should You Be Doing in 2018?

The Market seems to have picked up in the Q3 & Q4 of 2017, and there is a positive feeling that things will continue to look up in 2018 as Expo approaches. The biggest indicator of this is the double-digit attrition rates, which has been the highest since 2007 and is expected to fuel a boom in the economy.

Here are our top two tips for employers and business owners that will help to prepare for 2018:

- It will be important to have robust retention policies to retain talent, however these should cover more than just elements of compensation and benefits. More and more young talent are looking at more than just the pay cheque to keep them motivated and engaged with an organisation and therefore having robust retention policies in place can add value to the organisation

- Consider your readiness to attract talent from Generation Z which has already started to enter the workforce. This generation has very different expectations from their future employers, so you may need to review your HR practices in order to be prepared. For more information on how to prepare for Generation Z, refer to our newsletters on ‘The Future Summit’ and ‘Ready for the Centennial Workforce?’

If you would like assistance and support with any of the recommendations above, or to review your compensation and benefits packages please do not hesitate to get in touch with us on info@peoplefirstme.com.