This article looks at pay trends across the UAE in 2016 and makes recommendations on what employers should be thinking about for 2017.

While 2016 may not have been the best year in terms of pay trends, it was also not all doom and gloom for employees working in the UAE in 2016. The GDP growth was slow yet stable in 2016 and inflation rose from 3.0% to 3.4%. There may have been some cause for caution and uncertainty, but the good news is that the economy is not headed towards a recession.

Basic Salary

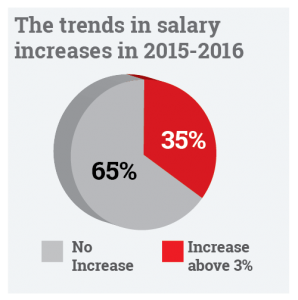

The trends in salary increases in 2015-2016 are summarized in the figure on the right. While 65% of the employees, did in fact, receive a pay increase, most of these salary increases were based on merit which resulted in pay increases averaging around 3.0% in those companies that implemented a pay review, with individual employees typically receiving between 0% and 6% linked to performance. Combining the 35% “no review” with the 65% “yes review”, means that in 2016, the overall trend for increases in basic salary was about 2.0% which brings us to the question; were the pay trends stable at all job levels, grades and across all industry sectors?

The trends in salary increases in 2015-2016 are summarized in the figure on the right. While 65% of the employees, did in fact, receive a pay increase, most of these salary increases were based on merit which resulted in pay increases averaging around 3.0% in those companies that implemented a pay review, with individual employees typically receiving between 0% and 6% linked to performance. Combining the 35% “no review” with the 65% “yes review”, means that in 2016, the overall trend for increases in basic salary was about 2.0% which brings us to the question; were the pay trends stable at all job levels, grades and across all industry sectors?

The tables below summarizes the growing differences in pay trends during 2016 at different job levels and across industry sectors. While senior management and management level employees enjoyed pay rises between 2.0% to 2.7%, increases for clerical roles were as low as 0.8%. Moreover, significant discrepancies were seen in the pay trends across industries, where on the one hand healthcare, FMCG, technology and automotive industries enjoyed an increase of up to 7.0%, the oil and gas industry experienced a decrease in salary of up to -2.0%

Table 1

| Pay Trends At Different Job Levels & Grades (2016) | |

| 2.3% to 2.7% | Senior Management |

| 2.0% to 2.4% | Management |

| 1.8% to 2.2% | Professional and Supervisory |

| 0.8% to 1.2% | Clerical and Admin |

Table 2

| Pay Trends Across Industry Sectors (2016) | |

| 6.0% to 7.0% | Healthcare |

| 4.5% to 5.0% | FMCG and Technology and Automotive |

| 3.0% to 3.5% | Insurance and Retail and Pharma |

| 2.0% to 2.5% | Banks and Financials and Conglomerates |

| 1.7% to 2.2% | Real Estate and F&B and Hotels-Hospitality |

| 1.5% to 2.0% | Public Sector and Construction |

| 1.0% to 1.5% | Transportation, Logistics and Cargo |

| -2.0% to 0.0% | Oil and Gas |

Similarly, the gap between salaries of Nationals and Expatriates also grew, with Nationals being paid 40% to 60% higher on guaranteed cash. The minimum gap of around AED 2,500 per month was seen at lower level roles and a maximum of about AED 9,000 per month at higher levels of management.

Allowances

While the trends for basic salary indicated an overall 2.0% increase, guaranteed fixed cash was also at 2.0%. In the UAE, allowances remained at the 60:40 split, and housing allowances were as good as being frozen as housing rental costs dropped by 8.0% in the period 2015-2016.

Bonus Payment

Actual bonus payments in early-2016 were at about 90% of On-Target which was down from 95% of On-Target from the previous year. The overall impact of this, puts the increase of total cash earnings at about 1.9% compared to basic salary and guaranteed cash which were at 2.0%.

Benefits

The overall total remuneration packages rose by about 2.2% as a result of an increase in benefits which rose by 5.0% to 7.0%. Average school fees went up by 3.0% to 5.0% and average medical insurance costs increased by 6.0% to 9.0%. This resulted in the cost of healthcare and education benefits becoming a cause for major concern as the limits were not in line with the actual expenditure. This means that education allowances are now sitting at an average reimbursement of 70% to 75% of the actual costs and is often now referred to as a subsidy.

In conclusion, after studying the pay trends from 2012 to 2016, and analyzing the forecasts for 2017, we believe that we might see pay trends increase slightly from 2.0% in 2016 to 3.0% in 2017. However, if we look at this in terms of real increases (after the impact of inflation), we think that pay increases will not keep pace with inflation in 2017, just like 2016, as caution continues to prevail in 2017.

What Should You Be Doing in 2017?

Market pay movements might continue to be lower than usual in 2017 again, but we think things will pick up in 2018 as Expo approaches. Companies now should be reviewing their HR policies, especially their Compensation & Benefits practices, and ensuring that they will be ready to react if and when the market picks up and the war for talent resumes. So what should you be doing?

- You should be reviewing your organization structure / design (OD) to make sure you have designed your organization optimally, and ensure that jobs are described properly and that KRAs and KPIs can be established for all jobs, to build and enhance your performance culture.

- You should be reviewing your grade structure to ensure that jobs are correctly graded and that you have the right number of grades to implement future talent management programmes to attract and retain key talent, and manage your career progression curves for top-performing employees. Whilst the 1990s-2000s saw a trend to reduce the number of grades, the trend now is back in the other direction, as many companies now are realizing that fewer grades means it is harder to control costs and harder to offer employees reasonably fast career progression. So getting your grade structure right is a crucial step for future success.

- You should be reviewing your pay strategy and reviewing your salary payscales and allowances to ensure that you are competitive with the market on guaranteed cash.

- You should be reviewing your bonus and incentive arrangements, both the core company-wide (excluding sales) annual bonus plan that should be linked to company results and employee performance, and the specific SIPs (sales incentive plans) for your sales force that should be geared to gross-margin (or revenue if gross margin cannot be measured) to ensure you are focusing your employees on results and ensure you are getting optimal motivation and performance from your variable pay practices.

- You should be reviewing the costs of your benefits plans, especially focusing on education allowances and medical insurance premium costs, and transitioning these from full-coverage to subsidies as you grapple with rising costs.

We at People First believe we are in a great position to help you with your journey in 2017, so if you want to discuss anything in this article, or if you want assistance and support with any of the recommendation above that you should be doing in 2017, then we would love to hear from you.

Definitions:

Guaranteed Cash refers to basic salary plus allowances such as housing and transport

Total Cash refers to Guaranteed Cash plus bonuses and incentives

Total Remuneration refers to Total Cash plus the costs of benefits provided by the employer